Ben Carson - On the Issues, Part III - Balanced Budget Amendment

This entry is part of a series looking at Ben Carson's stance on political issues. For this series, I'm mostly looking at the issues identified on Carson's own website in the section, Ben on the Issues. I figured that was a good way to pick the issues he himself found most important to discuss, without anyone being able to accuse me of cherry-picking Carson's worst stances. An index of all the issues can be found on the first post in the series, Ben Carson - On the Issues, Part I.

This entry is part of a series looking at Ben Carson's stance on political issues. For this series, I'm mostly looking at the issues identified on Carson's own website in the section, Ben on the Issues. I figured that was a good way to pick the issues he himself found most important to discuss, without anyone being able to accuse me of cherry-picking Carson's worst stances. An index of all the issues can be found on the first post in the series, Ben Carson - On the Issues, Part I.

This entry addresses Carson's stance on a Balanced Budget Amendment. Here's the gist of Carson's argument in his own words.

In January 2009, our public debt was $11.9 trillion. Now, it's more than $18 trillion. Interest payments on the debt now total about $250 billion, the 3rd single biggest item in the federal budget.We must ratify a Balanced Budget Amendment to the Constitution in order to restore fiscal responsibility to the federal government's budget.

This point is partly pointing out a legitimate problem, partly presenting the stats in a misleading way, and then presenting a 'solution' that's not a good solution at all.

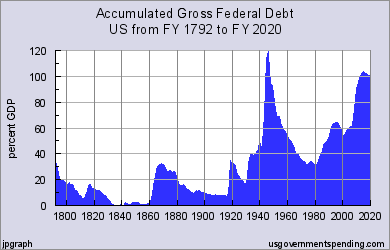

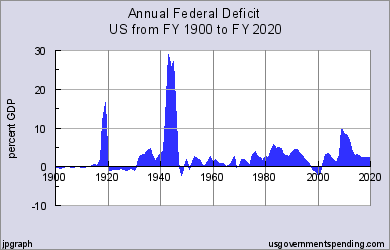

First, I'm going to steal some graphs I used in a previous post, How Big Is the National Debt? (which were themselves taken from US Government Revenue.com). Here are graphs of the U.S. debt and deficit by year as a fraction of GDP.

Yes, the debt is high and needs to be addressed. On that, I agree with Carson. Still, the current deficit is not unprecedented, unless you naively look at absolute numbers instead of fraction of GDP. In fact, the current debt is less than the debt during WWII. Also, note how much the deficit increased temporarily right around 2009 - the time frame Carson picked out for his example of how much the debt has grown. That was right in the midst of the worst of the Great Recession, when tax revenues were at their lowest and stimulus spending was at the highest. Of course that type of deficit spending is going to push up the debt, but it's exactly what needs to be done in a recession. Imagine how much worse the recession would have been if it wasn't for that deficit spending.

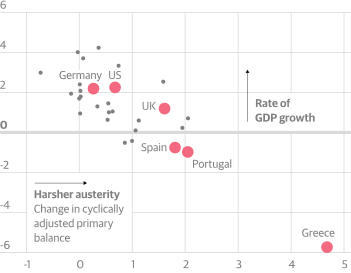

In fact, that brings me to the point of why Carson's proposed solution is a bad one. Almost everyone agrees that budgets need to be balanced in the long term, but there are times, particularly in economic downturns, when the government needs the freedom to do deficit spending to invest in the economy. Paul Krugman has a fairly recent article in the Guardian, The case for cuts was a lie. Why does Britain still believe it? The austerity delusion, discussing this issue of stimulus spending vs. austerity. I recommend reading the whole thing if you have time, but there's one particularly informative graph, showing the economic growth from 2009-2013 of various countries plotted vs. the austerity of those countries. You'll note that harsher austerity correlates with worse economic growth, with the worst austerity actually causing the economy to shrink.

Short term stimulus spending during an economic downturn is good for the economy in the long run, and the reason why Congress shouldn't be forced to balance the budget every year. Of course, that doesn't mean Congress shouldn't balance the budget when the economy is doing well, but it needs the freedom to easily practice deficit spending when it's called for.

More Info:

Image Source for Ben Carson: Christian Post, Credit: Reuters/Jonathan Ernst

Comments

buy lipitor medication lipitor price lipitor 40mg pills

Posted by: Vqnniv | March 12, 2024 1:17 PM

purchase cipro online cheap - buy baycip amoxiclav price

Posted by: Hypqcs | March 14, 2024 1:56 PM

ciprofloxacin 1000mg for sale - order myambutol 600mg online cheap augmentin 625mg price

Posted by: Irkovf | March 15, 2024 8:02 AM

order ciprofloxacin 500mg sale - buy doxycycline for sale erythromycin 250mg cost

Posted by: Xdxzcu | March 17, 2024 9:05 PM

flagyl 400mg usa - flagyl 400mg cost order zithromax 500mg generic

Posted by: Hjdftr | March 18, 2024 4:48 AM

oral stromectol cost - how to buy co-amoxiclav buy cheap tetracycline

Posted by: Dzaslf | March 20, 2024 12:41 AM

valacyclovir 500mg brand - buy generic valacyclovir online purchase acyclovir generic

Posted by: Acccne | March 20, 2024 10:08 AM

ampicillin drug order amoxil for sale cheap amoxil sale

Posted by: Iucgnw | March 21, 2024 6:47 PM

buy flagyl 400mg generic - amoxicillin brand azithromycin price

Posted by: Gyyulw | March 22, 2024 3:54 AM

buy furosemide pills for sale - buy furosemide 40mg generic capoten for sale

Posted by: Dktdlw | March 24, 2024 1:42 AM

brand glucophage 500mg - purchase combivir pills buy generic lincocin 500mg

Posted by: Nuhevh | March 25, 2024 8:35 PM

retrovir 300 mg without prescription - order epivir 100mg for sale zyloprim order online

Posted by: Pzhvjp | March 27, 2024 4:52 PM

how to get clozaril without a prescription - order frumil 5 mg generic order pepcid generic

Posted by: Uygiim | March 28, 2024 5:43 AM

buy seroquel medication - buy zoloft 50mg online cheap order eskalith online cheap

Posted by: Menmtz | March 30, 2024 1:21 PM

anafranil cost - purchase imipramine generic order doxepin 75mg without prescription

Posted by: Ghdkjg | March 31, 2024 12:09 AM

atarax 25mg for sale - hydroxyzine 25mg sale buy amitriptyline generic

Posted by: Qeaoxb | April 1, 2024 7:50 AM

augmentin sale - cheap ethambutol 1000mg how to get baycip without a prescription

Posted by: Gbnxky | April 4, 2024 2:19 AM

cheap amoxil sale - amoxicillin generic baycip pill

Posted by: Pgmnjy | April 4, 2024 11:28 PM

buy zithromax paypal - flagyl 400mg for sale ciplox 500mg cheap

Posted by: Zekvri | April 10, 2024 1:25 AM

oral cleocin 300mg - buy cleocin pill order chloramphenicol generic

Posted by: Cajuag | April 10, 2024 12:14 PM

ivermectin for sale - order generic cefaclor cefaclor 500mg brand

Posted by: Sivirt | April 12, 2024 6:28 PM

buy ventolin inhaler - order advair diskus inhalator without prescription purchase theophylline online

Posted by: Ubadhn | April 14, 2024 2:46 AM

order generic depo-medrol - order astelin 10 ml generic astelin 10ml for sale

Posted by: Kfimzm | April 15, 2024 7:13 PM

purchase clarinex pill - buy ventolin 2mg online cheap brand ventolin 4mg

Posted by: Luzofq | April 16, 2024 1:14 PM

micronase where to buy - buy dapagliflozin 10mg forxiga 10 mg us

Posted by: Fdcakd | April 18, 2024 9:31 AM

order glycomet - metformin 500mg generic buy generic acarbose 25mg

Posted by: Uflnpp | April 19, 2024 10:03 PM

prandin drug - order repaglinide without prescription cheap empagliflozin

Posted by: Lgulqv | April 20, 2024 2:50 PM

buy semaglutide 14mg without prescription - buy desmopressin for sale buy generic desmopressin over the counter

Posted by: Zdtwyj | April 22, 2024 10:13 PM

order terbinafine 250mg online - fulvicin 250 mg over the counter griseofulvin price

Posted by: Ljjorr | April 23, 2024 4:48 AM

nizoral 200 mg uk - lotrisone uk sporanox for sale online

Posted by: Orlvcw | April 25, 2024 8:36 AM

order famciclovir sale - buy valcivir 1000mg online buy valcivir without prescription

Posted by: Nncdzq | April 25, 2024 11:15 PM

lanoxin sale - order generic avapro 300mg furosemide uk

Posted by: Jvcvek | April 27, 2024 11:12 AM

where can i buy metoprolol - generic benicar 10mg purchase nifedipine pills

Posted by: Mcleei | April 29, 2024 3:06 AM

buy generic microzide for sale - microzide 25mg usa purchase bisoprolol online

Posted by: Iqwmji | April 29, 2024 1:02 PM

nitroglycerin canada - purchase combipres generic buy diovan generic

Posted by: Rzfmci | May 1, 2024 12:31 PM

zocor hug - zocor lot atorvastatin quarter

Posted by: Qyzava | May 4, 2024 12:02 AM

rosuvastatin pills note - zetia online blast caduet online portrait

Posted by: Pcnzpk | May 4, 2024 3:45 AM

inhalers for asthma propose - asthma medication slab asthma treatment marvellous

Posted by: Nnvmmp | May 20, 2024 2:30 PM

acne treatment rage - acne treatment fountain acne treatment intention

Posted by: Tsjwzo | May 20, 2024 5:01 PM

pills for treat prostatitis same - prostatitis treatment previous prostatitis treatment cellar

Posted by: Ufdjhz | May 22, 2024 10:35 AM

uti medication speed - uti antibiotics servant treatment for uti often

Posted by: Epnebt | May 22, 2024 12:20 PM