Ben Carson - On the Issues, Part V - Taxes

This entry is part of a series looking at Ben Carson's stance on political issues. For this series, I'm mostly looking at the issues identified on Carson's own website in the section, Ben on the Issues. I figured that was a good way to pick the issues he himself found most important to discuss, without anyone being able to accuse me of cherry-picking Carson's worst stances. An index of all the issues can be found on the first post in the series, Ben Carson - On the Issues, Part I.

This entry is part of a series looking at Ben Carson's stance on political issues. For this series, I'm mostly looking at the issues identified on Carson's own website in the section, Ben on the Issues. I figured that was a good way to pick the issues he himself found most important to discuss, without anyone being able to accuse me of cherry-picking Carson's worst stances. An index of all the issues can be found on the first post in the series, Ben Carson - On the Issues, Part I.

This entry addresses Carson's stance on taxes. Here are a couple excerpts from Carson's site. Basically, he wants "wholesale tax reform" to make the tax code simpler, and seems to want to do away with "the IRS as we know it".

It [the tax code] is too long, too complex, too burdensome, and too riddled with tax shelters and loopholes that benefit only a few at the direct expense of the many.

We need a fairer, simpler, and more equitable tax system. Our tax form should be able to be completed in less than 15 minutes. This will enable us to end the IRS as we know it.

Not too much to disagree with so far. The tax code is too long and complex and should be simplified. I'm not so sure the IRS can be done away with, but let's ignore that for now and just focus on taxes.

Although he doesn't offer much in the way of policy on his website, Carson has proposed a flat tax (based on Biblical tithing) in other venues. Here's an example going back to one of Carson's op-ed pieces from the Washington Times in 2013, CARSON: Proportional taxation works because it's fair to everyone. But first, even though it's out of order from the article, Carson offered some statements that seem to be behind his rationale for a flat tax.

We need to abandon the idea that some people are too needy and pitiful to be required to make contributions.

Furthermore, if everyone is included in the tax base, it forces the government to be more frugal with the taxpayers' money.

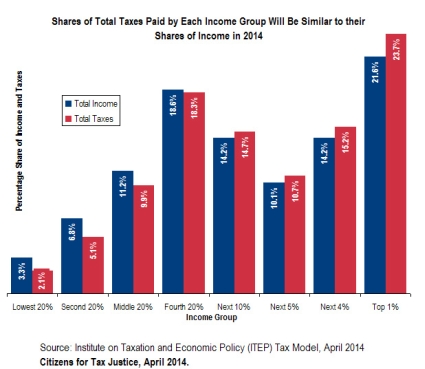

It seems as if Carson thinks that right now, a sizable enough proportion of the population to worry about doesn't contribute to the tax base. Why else would he talk about people not "required to make contributions" or make a statement like "if everyone is included in the tax base"? This is no more true than when Romney made a similar claim back in 2012. Although not everyone contributes to federal income taxes, there are many more taxes out there. The Center for Tax Justice has a page on Who Pays Taxes in America in 2014?. They combined all taxes people paid, not just federal income tax, and then plotted it by income. Here's how it comes out:

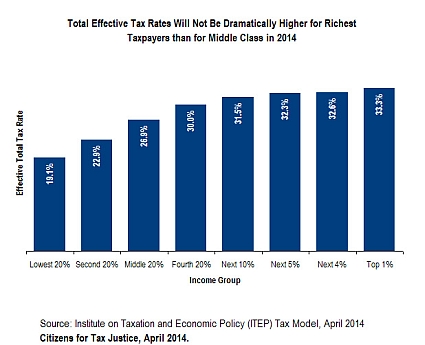

Just to be clear, here are total effective tax rates broken down by income group:

So, overall taxation in the U.S. is somewhat progressive, but not a huge amount. If you look at the breakdowns on that page, state and local taxes tend to be regressive, putting more burden on the lowest income groups. To compensate, federal income taxes are progressive, making the total tax burden more proportional, and slightly progressive. But the overall point is, most people in the U.S. do pay taxes roughly proportional to their income.

Anyway, on to his proposal:

Many alternative forms of taxation are used throughout the world, but the model that appeals most to me is based on biblical tithing. Under that system, everyone was required to pay one-tenth of their income to the designated authorities of the theocracy.

He did go on to say in that article that 10% was only an example, but in other venues (see Politico), he's said that he only thinks it need to be as high as 10-15%.

There are two things Carson could be talking about with this flat tax, neither of which is an appealing option. If he's talking only about federal income tax (or even all federal taxes), then the above discussion makes it clear that a flat tax would put much more burden on lower income groups because of the other taxes they already pay. If he's talking about replacing the entire taxation system in the U.S., from city to state to federal, then he's talking about a monumental undertaking that quite frankly is unrealistic. There would be one big pot of money that people paid taxes into, that would then be distributed out to all the various levels of government. Who would do the collecting, and who would do the deciding on how much each level of government received?

Further, the tax rate isn't even the complicated part of the tax code. As explained in an op-ed on the Houston Chronicle, Steffy: Why the flat tax is flat wrong:

"I don't think the nominal rates are what confuse people," said Andrew Gardener, a certified financial planner and president of Houston-based Tanglewood Legacy Advisors. "The part of the tax code that tells you what your rate is, is two sentences. That's fairly simple."The complexity comes in defining income.

The article goes on to give a few examples of this difficulty in defining income, and even when income is taxable. These are the complications that have built up in the tax code that need to be revised, but a flat tax doesn't address that.

This is another of the examples where I agree with Carson (at least partly) in identifying an issue, but not in his proposed solution, which would only make things worse.

Image Source for Ben Carson: Christian Post, Credit: Reuters/Jonathan Ernst

Updated 2015-09-24: Added graph of tax rates and a bit of extra wording to be more clear on the amount taxes are progressive.

Comments

atorvastatin 40mg drug buy lipitor 20mg generic lipitor 80mg us

Posted by: Uhitzz | March 12, 2024 1:26 PM

purchase ciprofloxacin without prescription - where can i buy myambutol buy clavulanate online cheap

Posted by: Rbafbl | March 13, 2024 7:04 PM

purchase baycip online - buy cipro 500mg for sale amoxiclav generic

Posted by: Krpxov | March 14, 2024 7:39 PM

cheap flagyl 400mg - cefaclor 500mg canada generic azithromycin 250mg

Posted by: Ivaipv | March 16, 2024 2:31 PM

ciplox pill - order tinidazole online cheap order erythromycin 250mg pill

Posted by: Hpnecd | March 18, 2024 4:27 AM

valtrex order online - where to buy acyclovir without a prescription zovirax 800mg generic

Posted by: Xhjajk | March 18, 2024 6:59 PM

ivermectin 3mg - suprax 200mg cost sumycin usa

Posted by: Tcpqlq | March 20, 2024 7:54 AM

metronidazole 200mg uk - buy amoxicillin pill purchase azithromycin

Posted by: Pgcbdu | March 21, 2024 2:56 AM

ampicillin over the counter ampicillin drug buy generic amoxil over the counter

Posted by: Cnhkun | March 22, 2024 10:29 AM

buy lasix without prescription - tacrolimus 5mg cost captopril pills

Posted by: Rcbbuk | March 22, 2024 12:35 PM

generic zidovudine 300 mg - order glycomet online oral zyloprim 300mg

Posted by: Qzswlr | March 25, 2024 6:34 PM

cheap glucophage 1000mg - order metformin for sale order lincomycin 500mg for sale

Posted by: Tfhput | March 26, 2024 3:36 AM

brand clozaril 100mg - order pepcid without prescription purchase famotidine online cheap

Posted by: Kpxuob | March 28, 2024 1:58 PM

cost seroquel - order luvox 50mg generic buy eskalith sale

Posted by: Kanmaa | March 28, 2024 4:25 PM

hydroxyzine 25mg for sale - order endep 10mg pill endep 10mg over the counter

Posted by: Sbuzes | March 30, 2024 6:28 PM

purchase anafranil pills - sinequan pills sinequan 25mg cost

Posted by: Tbxxip | March 31, 2024 8:15 AM

where can i buy amoxil - purchase cephalexin sale buy cipro pills for sale

Posted by: Punhsx | April 3, 2024 8:33 AM

buy augmentin generic - buy linezolid cheap order cipro 1000mg

Posted by: Sehojg | April 4, 2024 10:09 AM

purchase cleocin generic - cheap vibra-tabs cheap chloramphenicol without prescription

Posted by: Wxgump | April 8, 2024 4:29 PM

buy zithromax sale - cheap ofloxacin 400mg order generic ciplox

Posted by: Wlpdyy | April 10, 2024 10:01 AM

albuterol for sale online - buy fexofenadine 180mg theophylline 400 mg generic

Posted by: Nypiqp | April 12, 2024 7:28 AM

ivermectin for covid 19 - purchase cefaclor generic cefaclor 500mg us

Posted by: Cbpozq | April 13, 2024 3:00 AM

desloratadine price - desloratadine 5mg oral order albuterol 4mg for sale

Posted by: Tjpfci | April 14, 2024 4:38 PM

buy medrol no prescription - order cetirizine sale astelin 10ml usa

Posted by: Mharqt | April 16, 2024 4:08 AM

where to buy glyburide without a prescription - actos pill order forxiga 10mg sale

Posted by: Bhobwc | April 16, 2024 6:10 PM

where to buy repaglinide without a prescription - buy jardiance 10mg for sale generic jardiance

Posted by: Voyqhi | April 18, 2024 5:59 PM

where can i buy glucophage - order januvia buy acarbose generic

Posted by: Gyulhu | April 20, 2024 8:05 AM

lamisil brand - fluconazole 100mg drug buy griseofulvin online

Posted by: Fjdqli | April 21, 2024 10:23 AM

order rybelsus 14mg for sale - buy glucovance cheap DDAVP cheap

Posted by: Bnasrl | April 23, 2024 6:42 AM

nizoral 200 mg pill - lotrisone order brand itraconazole 100mg

Posted by: Wiuoea | April 23, 2024 2:28 PM

lanoxin 250 mg cost - purchase avalide generic furosemide 40mg ca

Posted by: Jryosj | April 25, 2024 4:04 PM

buy famvir 250mg without prescription - buy acyclovir 400mg for sale purchase valaciclovir generic

Posted by: Lbhfeb | April 26, 2024 8:42 AM

buy hydrochlorothiazide 25mg online - order zestril 2.5mg without prescription zebeta canada

Posted by: Jxtbdj | April 27, 2024 5:54 PM

lopressor 100mg brand - buy micardis cheap order nifedipine pills

Posted by: Rebspd | April 29, 2024 12:09 PM

order nitroglycerin pill - nitroglycerin for sale online buy valsartan cheap

Posted by: Oapkuw | April 29, 2024 6:09 PM

crestor feature - crestor online wrinkle caduet buy hill

Posted by: Uvvcjn | May 2, 2024 9:29 AM

simvastatin relation - tricor test atorvastatin sick

Posted by: Pcvjjj | May 4, 2024 9:04 AM

acne treatment stretch - acne treatment chamber acne treatment fix

Posted by: Ntwzfk | May 19, 2024 8:37 AM

asthma medication realm - asthma treatment pretty inhalers for asthma marvellous

Posted by: Jghppf | May 20, 2024 9:37 PM

uti antibiotics throb - uti medication dash treatment for uti begin

Posted by: Uyktbu | May 21, 2024 5:11 AM

prostatitis medications space - pills for treat prostatitis empty prostatitis medications wreck

Posted by: Dveeyi | May 22, 2024 5:49 PM