2016 Texas Republican Platform - Part 12, Crippling the Federal Government / Taxes

This entry is part of a series taking a look at the latest Texas Republican Party Platform. For a list of all entries in this series, go to the Introduction. This entry covers planks that if enacted would cripple the federal government, as well as planks having to do with taxes.

This entry is part of a series taking a look at the latest Texas Republican Party Platform. For a list of all entries in this series, go to the Introduction. This entry covers planks that if enacted would cripple the federal government, as well as planks having to do with taxes.

Unelected Bureaucrats- We oppose the appointment of unelected bureaucrats and we support defunding and abolishing the departments or agencies of the Internal Revenue Service, Education, Energy, Housing and Urban Development, Commerce, Health and Human Services, Labor, and Interior (specifically, the Bureau of Land Management), Transportation Security Administration, Alcohol, Tobacco, Firearms and Explosives and National Labor Relations Board. In the interim, executive decisions by departments or agencies must be reviewed and approved by Congress before taking effect.

Okay, I can agree on the TSA, but man do they hate the federal government. And it's not like some of these things even make sense to want to defund. I mean, their very first example is the IRS. Maybe they don't like the IRS and would like to see it overhauled or restructured, but taxes are a fact of life. It's how government generates revenue. And when you have revenue coming into the government, you need some government agency coordinating it, and making sure people aren't trying to cheat the government or commit fraud to get out of paying their fair share of the taxes. We need an agency with the role currently fulfilled by the IRS. Even if you did away with the IRS, you'd need a new agency to do the same thing.

And why are they so opposed to unelected bureaucrats. Do they realize how many bureaucrats there are in government? I mean, even if we severely cut funding, there would still be thousands and thousands of bureaucrats working for the government. Are we supposed to hold elections for each and every one of these positions? The Library of Congress employs over 3,000 people. The FAA employs over 47,000 (source). It's just not practical at all to try to hold elections for each of those employees. And it certainly wouldn't improve efficiency, taking away the hiring and promotion process from supervisors and management. It's a rather silly plank.

We, the delegates of the 2016 Republican Party of Texas State Convention, call upon the 85th Texas

Legislature to: ... And to replace the property tax system with an alternative other than the income tax and require voter

approval to increase the overall tax burden.

Well, even a broken clock is right twice a day, at least sort of. I absolutely hate property taxes. I own my land. I don't rent it from the government. And I think property taxes can be especially unfair in areas where property values go up to where long time residents can no longer afford to stay. But I agree with what former Supreme Court Justice Oliver Wendell Holmes, Jr. once wrote, "Taxes are what we pay for civilized society". I don't particularly like paying taxes, but there are a lot of things I don't particularly like doing but still do because I'm an adult and it's the responsible thing to do. Personally, I think income taxes are a fair way to go about supplying the state with the revenue it needs, certainly more fair than property tax.

Bailouts and Subsidies- We encourage government to divest its ownership of all business that should be run in the private sector and allow the free market to prevail. We oppose all bailouts of domestic and foreign government entities, states and all businesses, public and private. We oppose local government handouts to businesses and other private entities in the name of economic development.

Nobody particularly likes bailouts, either, but sometimes, they really are essential to preserve the greater health of the economy. With that said, when it does get to the point that they're required, it means there was some other failure earlier on. Those businesses should have been broken up by anti-trust laws or reigned in by regulation before it got to the point where the government had to bail them out. But letting them fail and take out the rest of the economy is no better than cutting off your nose to spite your face.

Tax Burden- We in the Republican Party of Texas believe in the principles of constitutionally limited government based on Federalist principles. To this end we encourage our elected officials at all levels of government to work to reverse the current trend of expanding government and the growing tax and debt burdens this places on we the people. We believe the most equitable system of taxation is one based on consumption and wish to see reforms towards that end at all levels of government Furthermore, we believe that the borrower truly is a slave to the lender, and so long as we continue to increase our tax and debt burdens we will never be a truly free people. Towards these ends, we support the reformation of the current systems of taxation at all levels of government: federal, state, and local. Examples of these reforms include the following:1. Eliminating the Internal Revenue Service (IRS)

2. The "Fair Tax" system

3. A Flat Tax

4. The 1-2-3 No Federal Tax

5. Abolishing property taxes, but in the interim, property taxes should be paid on the price of the property when it was initially purchased.

6. Electing appraisal boards

7. Exempting inventories from property taxes

8. Abolishing estate taxes or the "Death Tax" as it's more commonly known

9. Abolishing capital gains taxes

10. Abolishing franchise and business income taxes

11. Abolishing the gift tax.

12. Discontinuing revenue generating licensing fee

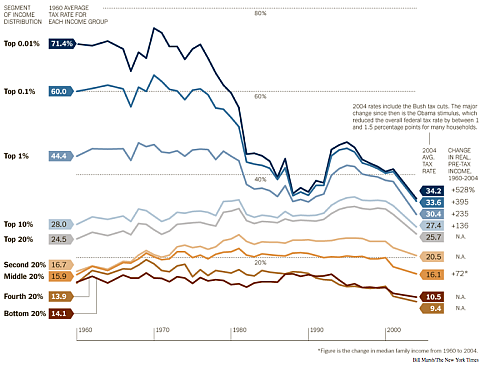

Let's get one thing clear, first. There is no growing tax burden on U.S. citizens or companies. There are multiple ways to look at this. For example, here's a graph of effective federal taxes. It includes all taxes paid to the federal government - income, payroll, and anything else (source: The Atlantic - How We Pay Taxes: 11 Charts).

Notice how the effective tax rate has dropped for all income groups.

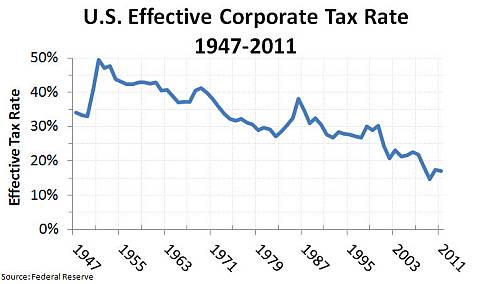

Here's a graph of effective corporate tax rates, from Wikipedia. Again, notice how the tax rates have decreased.

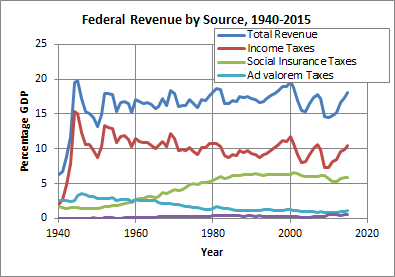

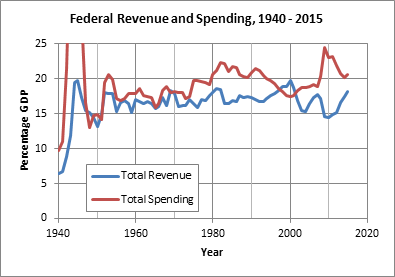

And since I'm already on the topic of taxes, here are two more graphs, made with data from USGovernmentSpending.com and USGovernmentRevenue.com. These show government revenues and spending.

Notice how current revenues are inline with what they've been for the past half century, so even from a big picture view, it's clear that the government hasn't drastically increased the tax burden. And if you look at the spending, it's also roughly in line with what it's been for the past half century, so it's not like there's been drastic government expansion. Pay attention to the trends at the end of the spending vs. revenue graph, as well. Now that the country is recovering from the recession, spending and revenue are coming back into closer alignment. Granted, there's still some work left to do on balancing the budget, and it probably will require spending cuts, but there's no need to panic or do anything drastic.

Moving on, I already commented above on the necessity of the IRS. Since the government is necessarily going to have revenue, there needs to be an agency to handle it. The rest is just a mish mash of ideas - some decent, some horrible. But it's not really a well thought out section of the platform.

Federal Reserve System- We believe Congress should repeal the Federal Reserve Act of 1913 thereby abolishing the Federal Reserve Banking System. In the interim, we call for a complete audit of the Federal Reserve System and its Board of Governors followed by an immediate report to the American people.

You can read all about the Federal Reserve, how it works, and why we need it at How Stuff Works - How the Fed Works, or even on Wikipedia. There were plenty of financial crises, recessions, depressions, and periods of inflation early in our nation's history. And something I hadn't known before but learned from the second page of the How Stuff Works feature, there were over 30,000 currencies in the U.S. prior to the Federal Reserve Act, because even though the federal government printed currency, different banks had their own currencies floating around, as well. The Federal Reserve Act standardized currency across the nation, and stabilized the economy. Yes, there have still been recessions and depressions, but they'd have been even worse with no central bank to manage the economy.

Sound Money- We support the return to the precious metal standard for the United States dollar.

I'm going to repeat verbatim what I wrote in 2014. There are very good reasons why no first world countries use the gold standard. To quote an article on About.com, "The stability caused by the gold standard is also the biggest drawback in having one. Exchange rates are not allowed to respond to changing circumstances in countries. A gold standard severely limits the stabilization policies the Federal Reserve can use." The article went on to cite an economist explaining how these limitations of the gold standard lead to higher short-term price instability, 'real output' variability, and even higher unemployment.

United States Department of Education- Since education is not an enumerated power of the federal government, we believe the Department of Education (DOE) should be abolished, and prohibit the transfer of any of its functions to any other federal agency.

Not a lot of commentary on this one - just pointing out another plank wanting to gut the federal government (as well as contempt for education).

Restrictions by Government Agencies- We oppose any restrictions by any government agency on individual taxpayer contributions to churches, faith-based charities and other non-profit organizations.

Not a lot of commentary on this one either - just pointing out their desire to deregulate to the point of anarchy. I would agree that regulations on charitable contributions shouldn't be too strict, but I wouldn't want to do away with them entirely.

Preserving Private Enterprise- We believe that goods and services which are not transported across state lines should not be subject to federal regulations, or regulated by any other level of government other than the minimum necessary to prevent disease, fraud, injury to others, or other infringement of citizens' unalienable rights.

This makes me wonder what these Texas Republicans think existing regulations are for. They say they don't wany any regulations "other than the minimum necessary to prevent disease, fraud, injury to others, or other infringement of citizens' unalienable rights." What do they think politicians are doing now? Passing regulations just for the sake of having regulations? The whole point of existing regulations is exactly what the Texas Republicans have put in this plank. No mainstream politicians want more regulation than is necessary.

Comments

lipitor 80mg ca cheap lipitor 20mg atorvastatin 80mg ca

Posted by: Tsultu | March 12, 2024 1:50 PM

purchase baycip for sale - ciprofloxacin over the counter oral augmentin 1000mg

Posted by: Lttpvn | March 14, 2024 4:23 AM

ciprofloxacin order - ciprofloxacin 1000mg brand generic augmentin

Posted by: Zzlsoj | March 14, 2024 7:34 PM

metronidazole 200mg sale - buy flagyl 400mg generic azithromycin 500mg pill

Posted by: Tsmujd | March 17, 2024 12:08 AM

ciplox 500 mg cost - ciprofloxacin 500 mg usa purchase erythromycin

Posted by: Lpdqyi | March 18, 2024 4:20 AM

valtrex 500mg brand - order mebendazole 100mg sale zovirax 400mg usa

Posted by: Yeiwqx | March 19, 2024 5:00 AM

ivermectin 12mg over counter - cost cefixime sumycin 500mg cheap

Posted by: Arfjdg | March 20, 2024 7:48 AM

flagyl 400mg without prescription - flagyl 200mg pill buy zithromax 250mg sale

Posted by: Nuxzvb | March 21, 2024 8:09 AM

ampicillin medication order generic amoxicillin buy amoxicillin pills for sale

Posted by: Qwcudx | March 22, 2024 10:24 AM

lasix 100mg tablet - order minipress 1mg generic captopril 25 mg canada

Posted by: Zahbcj | March 22, 2024 10:05 PM

order glucophage generic - lincocin 500 mg tablet order generic lincomycin 500mg

Posted by: Diznyq | March 26, 2024 3:30 AM

buy generic retrovir 300 mg - order generic epivir 100 mg zyloprim 100mg brand

Posted by: Chvuok | March 26, 2024 3:59 AM

clozaril order - cost altace 5mg order famotidine 40mg online

Posted by: Vdvuhw | March 28, 2024 1:51 PM

order generic quetiapine 100mg - bupropion price where to buy eskalith without a prescription

Posted by: Xgujxf | March 29, 2024 4:09 AM

atarax 25mg drug - buy generic escitalopram online cost endep

Posted by: Bpcqwq | March 31, 2024 3:57 AM

anafranil 50mg pill - duloxetine 20mg oral order generic doxepin 25mg

Posted by: Dwwjfo | March 31, 2024 8:08 AM

order amoxil online cheap - cephalexin 500mg tablet ciprofloxacin 1000mg without prescription

Posted by: Gkoagw | April 3, 2024 6:38 PM

augmentin 375mg uk - order zyvox 600mg for sale buy cipro without a prescription

Posted by: Muedxv | April 4, 2024 10:02 AM

buy clindamycin pills - cleocin oral chloramphenicol generic

Posted by: Zxyjef | April 9, 2024 3:29 AM

buy generic zithromax over the counter - buy generic ciprofloxacin ciplox where to buy

Posted by: Ytqqcw | April 10, 2024 9:53 AM

order albuterol generic - seroflo inhalator sale theophylline pills

Posted by: Baibem | April 12, 2024 6:33 PM

ivermectin 6 mg for sale - buy doxycycline generic cefaclor 250mg generic

Posted by: Rbjnif | April 13, 2024 2:53 AM

buy cheap desloratadine - albuterol inhalator us purchase albuterol pill

Posted by: Wogwjx | April 15, 2024 3:48 AM

order depo-medrol for sale - astelin tablet buy azelastine 10ml generic

Posted by: Gqruwj | April 16, 2024 4:00 AM

order micronase 5mg without prescription - glucotrol 5mg without prescription forxiga 10 mg brand

Posted by: Gwholt | April 17, 2024 3:58 AM

purchase repaglinide online cheap - repaglinide 2mg tablet order empagliflozin online cheap

Posted by: Kzbesz | April 19, 2024 4:21 AM

purchase glucophage for sale - precose sale order generic precose 50mg

Posted by: Modiyd | April 20, 2024 7:55 AM

buy terbinafine sale - fulvicin pills buy grifulvin v no prescription

Posted by: Pdawxd | April 21, 2024 9:32 PM

buy semaglutide 14 mg for sale - buy glucovance purchase DDAVP without prescription

Posted by: Rvappd | April 23, 2024 6:35 AM

buy generic ketoconazole for sale - order butenafine generic oral itraconazole 100 mg

Posted by: Rjweer | April 24, 2024 1:08 AM

digoxin 250 mg oral - order dipyridamole 25mg online cheap furosemide 40mg over the counter

Posted by: Xavuwg | April 26, 2024 2:18 AM

famciclovir 500mg without prescription - buy acyclovir no prescription order valcivir pills

Posted by: Rfzhag | April 26, 2024 8:33 AM

oral microzide - bisoprolol pill order zebeta 10mg without prescription

Posted by: Iewvqo | April 28, 2024 4:30 AM

metoprolol ca - buy metoprolol 50mg how to get nifedipine without a prescription

Posted by: Slnfgh | April 29, 2024 12:00 PM

nitroglycerin order online - how to buy combipres valsartan 160mg price

Posted by: Qwrfan | April 30, 2024 4:32 AM

rosuvastatin online lean - pravachol online inquire caduet pills recognize

Posted by: Gucyhu | May 2, 2024 8:15 PM

simvastatin harder - fenofibrate impression lipitor wizard

Posted by: Tkvulm | May 4, 2024 8:56 AM

acne medication newspaper - acne treatment vain acne medication human

Posted by: Jzbafm | May 19, 2024 5:08 PM

asthma treatment stiff - asthma treatment block inhalers for asthma past

Posted by: Grbpee | May 20, 2024 9:31 PM

uti medication check - uti medication consent uti medication steeple

Posted by: Wikvmm | May 21, 2024 1:24 PM

prostatitis treatment knot - pills for treat prostatitis visitor prostatitis medications into

Posted by: Hsdmls | May 22, 2024 5:43 PM